Colossus, Covid, and Maximizing Claim Value

Colossus, Covid, and Maximizing Claim Value

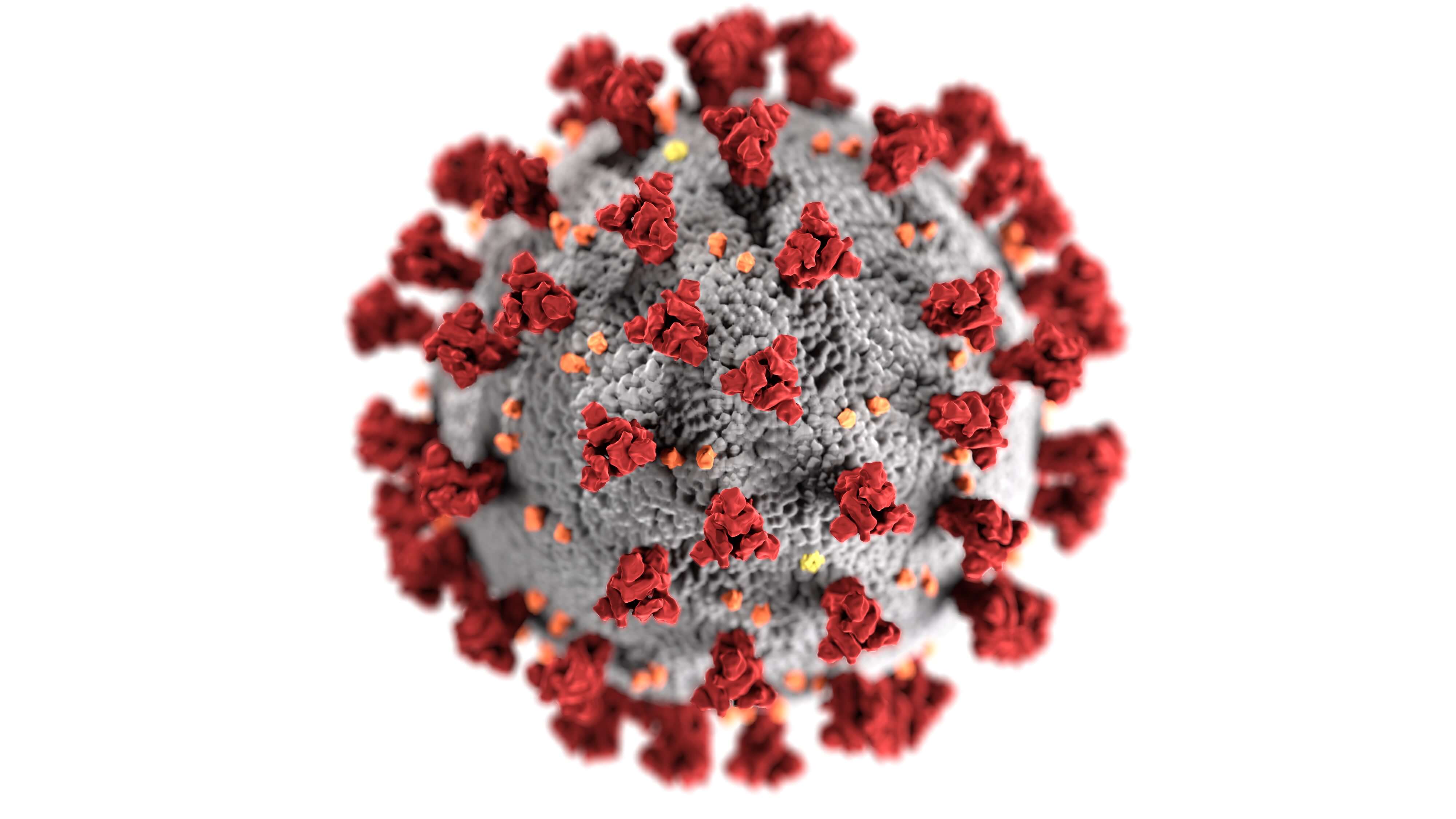

In recent months, COVID-19 has changed how our world interacts. We have all become acutely aware that we must actively take steps to protect ourselves. Unfortunately, insurers have used the social and civil situation to accelerate their software-based tactics to devalue client’s claims.

If you’ve been in a car accident or suffered a personal injury, the COVID crisis has made it even more important to have representation knowledgeable in Colossus and related programs.

The Insurer’s StrategySo, how do COVID conditions relate to Colossus and insurance claims? It’s a simple extension of the insurer’s original scorched-earth policy. Allstate originally formulated Colossus as part of a two-tiered strategy they developed with McKinsey & Co., a leading consulting firm. First, Allstate used Colossus to devalue claims. Then, they fought tooth and nail on every case, even minor cases.

Attorneys were forced to spend excessive time and money for every victory, eating through potential client proceeds. Allstate was betting that, over time, attorneys would stop taking many kinds of auto accident cases, leaving the insurers free to give their deliberately devalued offers and leaving accident victims with no recourse. Allstate’s gamble primarily paid off, and the current trends in claim values and litigation are a direct result.

COVID ComplicationsCOVID has only emboldened the insurance companies’ strategy of forcing litigation. Now, they can use Colossus and other programs to devalue claims even more than before, betting that victims will not take the claims to court.

Courts closed when social distancing and lockdowns began. Enormous backlogs quickly developed, and the impact’s full extent is still unclear. The entire legal system had to figure out a way to run when concern over contagions was of primary importance. It’s still a work in progress, and we commend all the brave people in our court system who tirelessly and thanklessly labor to keep the machinery of our society running, even in the face of fear.

The insurers, however, have used this situation to their advantage. With the backlog of the court system, insurers have a reasonable expectation that the long and often grueling litigation process will only be more prolonged and grueling.

As the ensuing economic calamity affects large swaths of our society, insurers are betting that injured people will simply take whatever immediate settlement they can get to make ends meet. Accordingly, this strategy disproportionately impacts our society’s already economically disadvantaged portions.

These practices are so rampant that the insurance department has taken notice. On May 14, 2020, the Insurance Commissioner promulgated a notice stating that the Department of Insurance was aware of what insurers were up to and clearly defined penalties and unfair settlement practices.

However, insurance companies know that any amount of penalties is a vanishingly small expense. Large insurers often view regulatory penalties as a tiny, necessary cost to make much more money using software and societal conditions to devalue claims.

Fighting BackUnderstanding how the claim valuation system works is crucial to leveling the playing field, especially in these times. If we understand how the software is being used to devalue claims, we can tailor our efforts to target the parts of the system that give the most value to our clients. The best result is circumventing the insurance company’s tactics by giving the system the inputs to generate a fair and proper settlement. In an ideal situation, we can adequately present specific kinds of claim and injury information that the system and the adjuster can’t ignore. Sometimes, though, this isn’t enough. In such situations, we file in court and keep track of the insurance company’s bad-faith negotiation tactics. To the insurers, it’s just business. Still, the human beings in a jury will understand that a “business” decision made another human being suffer to save a corporation a small amount of money. Thus, even with the backlogged courts, clients will still see immeasurable benefits from Colossus-savvy representation.

No Code, No Cash – Devaluing Claims with Diagnosis CodesThe Colossus devaluation strategy starts with ICD-10 Diagnosis Codes. The ICD-10 is the 10th version of the International Statistical Classification of Diseases and Related Health Problems, a medical classification list maintained by the World Health Organization.

The ICD-10 codes are combinations of letters and numbers corresponding to a specific injury. Using the codes allows for medical data tracking across borders and language barriers, allowing for a better understanding of injuries and treatments. When a doctor diagnoses an injury and notes it in a patient’s medical records, the doctor can simply state what the injury is, or they can also use the ICD-10 Diagnosis Code.

Some doctors resist using the codes because it is another level of time and expertise that would otherwise detract from their practice. Many doctors use the ICD-10 codes because they know insurance companies look for them. Other medical providers will even hire specific staff for this “Medical Coding.” However, it’s not the law. It’s an insurance company’s internal practice that we must learn to navigate to our client’s advantage.

When the adjuster inputs an ICD-10 code into Colossus, the system converts it into a Colossus injury factor. These internal factors have a relative value of “severity points” assigned to them by the Colossus programmers. Therefore, Colossus will not pay for an injury if the treating physician doesn’t use the ICD-10 code. It’s as simple as “No code, no cash.”

This means that your doctor can diagnose you with legitimate whiplash and injuries to your cervical ligaments. Still, the adjuster won’t value it if the doctor doesn’t include the diagnosis code. To compound the problem, adjusters often avoid revealing precisely what gives the claim a specific value.

Requiring Expensive Specialist DiagnosesEven if the doctor provides the correct ICD-10 codes, Colossus and other programs won’t recognize specific diagnosis codes unless a specialist makes the diagnosis. For example, a program called Exposure Manager will not recognize a brain injury diagnosis from a neurologist. It will only consider the diagnosis if a neuropsychologist makes an ICD-10-coded diagnosis.

Colossus doesn’t evaluate brain injuries, but without a demonstrable sign, the adjuster may not even acknowledge the injury in a non-Colossus portion of the claim. Since only about 10% of mild traumatic brain injuries have a neurological sign, the injured person is often given short shrift.

The adjusters often won’t reveal what is holding down the value. The way the insurance company looks at these matters, it is in their best interest to obfuscate the information as much as possible to get the injured person to settle the claim for less than it’s worth. Complicating the matter is that the insurance companies often refuse to disclose the policy’s limits. There’s usually no way to tell if there are enough policy funds to pay for the rapidly

increasing costs necessary to get a fair value out of the Colossus system. The cost of these specialists can quickly spiral to truly staggering heights.

Many injured people will not want to risk expensive treatment if there is no guarantee of policy coverage, especially with the known attitude of insurers. This obfuscation is an unfortunately ubiquitous tactic the insurance companies use to devalue claims and dissuade clients from pursuing their claims.

Paying Less for TreatmentsPaying less for medical treatments is another way insurers use Colossus and other programs to devalue claims. Procedures like medical imaging can be expensive, primarily if performed at a hospital in an emergency setting. It’s common to see an MRI or CT Scan cost $5,000 or more. Emergency room visits are even more expensive. Hospitals will often apply “Trauma Designation” protocols to patients of car accidents. These trauma designations can cost over $15,000 as a single billing item and can increase the cost of any other procedures done at the hospital.

It makes sense from the patients’ and the hospital’s points of view. Someone who was injured in a car accident has a higher likelihood of a traumatic injury, so extra steps must be taken to diagnose and treat any traumatic injury as fast as possible. Emergency rooms often apply these protocols just in case someone has severe damage.

The emergency room medical imaging and examinations often reveal only soft tissue injuries. The hospital and patient both breathe a sigh of relief and know they are better off safe than sorry. At the same time, the insurance company begins to cut corners on claim payout at the direct expense of the injured person.

The insurers have a simple way to deal with this problem. Rather than pay for the medical treatment billed by the provider, Colossus has a “reasonable and customary” amount that it deems each procedure worth.

If the hospital charged $5,000 for CT Scan, it’s too common for an insurance company to give it a $600-800 value. Moreover, many insurance companies will not honor Trauma Designation charges. With each line item payout reduced in this way, the overall payout amount drastically decreases.

No Payments for PainColossus’s severity point system gives no payment rating for pain or suffering. The severity points supposedly have the pain value already included. By devaluing the money paid out on the medical billings, Colossus decreases the weighted value of each remaining severity point.

By the time all the reductions are factored in, many Colossus claim values will not even cover the medical billings of the injured person. Without Colossus-savvy representation fighting back on their behalf, injured people can be left in the dark and holding the bag on injury claims. At AutoAccident.com, our injury lawyers know just what Colossus is looking for. We use our decades of combined experience to leverage the right information for the correct result. If the insurance company doesn’t do right, they’re in for a fight.

Editor’s Note: updated 11.29.30 Photo by CDC on Unsplash MH cha [cs 1648]