Auto Insurance: Types and Purpose of Coverage

Auto Insurance: Types and Purpose of Coverage

Understanding our automobile insurance coverages is key to protecting ourselves financially (1) should we get injured in a car accident or other traffic incidents, (2) should our vehicle or other personal properties be damaged in a collision or other incident or theft, or (3) should we be responsible ourselves for causing injury or property damage to someone else in a crash. Understanding the coverages also helps us shop for the insurance companies and policies that best fit our needs by being able to make “apples-to-apples” comparisons of coverage quotes from different insurers.Reviewing Insurance Policy Declaration Page

Understanding our automobile insurance coverages is key to protecting ourselves financially (1) should we get injured in a car accident or other traffic incidents, (2) should our vehicle or other personal properties be damaged in a collision or other incident or theft, or (3) should we be responsible ourselves for causing injury or property damage to someone else in a crash. Understanding the coverages also helps us shop for the insurance companies and policies that best fit our needs by being able to make “apples-to-apples” comparisons of coverage quotes from different insurers.Reviewing Insurance Policy Declaration PageLet’s take a look at some common coverages from an automobile insurance policy declaration sheet (or “dec sheet”):

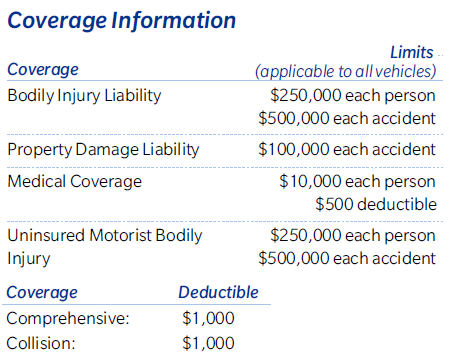

This summary shows different types of auto insurance, including:

- Bodily Injury Liability Coverage

- Property Damage Liability Coverage

- Medical Coverage

- Uninsured Motorist Bodily Injury Coverage

- Collision Coverage

- Comprehensive Coverage

- Other Types of Coverages

Bodily Injury Liability Coverage is shown above in the maximum amount of $500,000 per accident and $250,000 per person. This coverage protects you as an individual if a claim or lawsuit is made against you for having caused injury to another person in a traffic incident (or if someone who was driving your car did so). The “per accident” coverage is the normal maximum payout that will be made on your behalf for any single accident. The “per person” coverage is the normal maximum payout that will be made on your behalf to an individual for any single accident. Where there are multiple claims from a single accident, both limits will apply.

Bodily injury liability is typically a coverage required by law. Minimum insurance coverage in California is “15/30.” In other words, the minimum amount your insurance must cover per accident is $30,000 and per person is $15,000. The purpose of minimum insurance coverage is to ensure you meet the state legal requirement to operate a motor vehicle on public roads and pay for damage or injuries to others when you are at fault in a crash. Most insurers provide this type of coverage with “split limits” per person and per accident, as for example, 15/30, 25/50, 30/60, 100/300, 250/500, etc. Some policies, however, have a single limit of coverage for both accident and individual.

Together with property damage liability, this coverage is typically the most expensive part of your insurance policy. Typically, it’s also the part of your coverage most impacted by your past driving history. If you have a problematic driving record, liability coverage is going to cost you more.

Property Damage Liability CoverageProperty Damage Liability Coverage is shown above in the maximum amount of $100,000 per accident. This coverage protects you as an individual if a claim or lawsuit is made against you for having caused damage to another person’s vehicle or personal property in a traffic incident (or if someone who was driving your car did so). This is usually written as a single, maximum dollar value per accident. This is another coverage that is usually required by law. In California, an insurance policy must have a minimum of $5,000 in property damage liability coverage.

Medical CoverageMedical Coverage, also known as Medical Payments or “Med-Pay,” is shown above in the maximum amount of $10,000 per person. Med-Pay coverage is available to each and every person in your vehicle who might be injured in an automobile collision. The coverage applies to any medical bills that might result due to injuries from the accident.

Med-Pay coverage is an optional coverage – you don’t need to purchase any – but it’s usually a wise coverage to purchase because (1) it’s “no-fault” insurance – it’s available no matter who caused the accident; (2) it’s usually a pretty good buy – it doesn’t add a lot to your insurance bill; and (3) it can help you whether or not the person who caused your injuries has liability insurance that might cover your medical bills.

Med-Pay coverage is usually a flat rate, but the sample shown above has a “deductible” of $500, meaning that it’s available to cover any and all of your medical bills beyond the first $500 worth. Med-Pay coverage has many quirks and complications, however, so read on to find out more about how it works.

Uninsured Motorist Bodily Injury CoverageUninsured Motorist Bodily Injury Coverage, also known as “UM” coverage protects you and your vehicle’s passengers if you’re injured by another driver who has no bodily injury liability coverage. It may also provide you with underinsured or “UIM” coverage if the responsible driver has an inadequate policy with coverage less than your own UM/UIM coverage limits. It’s shown above in the maximum amount of $500,000 per accident, and $250,000 per person. Similar to bodily injury liability coverage, UM is usually offered in “split limits” amounts per person and person accident, but again some policies will offer a single limit maximum coverage.

Uninsured/underinsured motorist coverage is not required in California, but it probably should be. We can’t tell you how many times we’ve had to say to a client with a major injury that only $15,000 is available to compensate them for their loss because the responsible driver only had a minimum required 15/30 bodily injury liability policy (or no coverage at all) and because the client had no UM/UIM coverage. UM/UIM coverage directly benefits you and your passengers.

It also tends to be inexpensive compared to other coverages on your policy. In the policy above with 250/500 bodily injury coverage and 250/500 uninsured motorist coverage, the UM portion only costs about a third as much as the liability portion. The rules for uninsured motorist coverage and underinsured motorist coverage a quite complex, so read on for more details.

The video below discusses whether there is enough insurance to cover a client’s damages.

Collision CoverageCollision Coverage is shown above with a $1,000 deductible. Collision coverage pays for damage to our own automobile if it’s damaged in a traffic collision or other “moving” event, such as running into a stationary object. The “deductible” is what the insurance company deducts from the full repair bill (or total loss value for a vehicle that is “totaled”) before paying out.

Collision coverage isn’t required by law in California. Still, if you are leasing a vehicle or paying on a car loan, your leasing company or loan company – which has a direct interest in the value of the car – will almost always require you to carry collision coverage. Once you’ve paid off a car loan, you may or may not want to continue carrying coverage collision on your insurance. If you can afford to pay for damage or loss to the vehicle out of pocket, then you may save money by dropping the coverage. Certainly, for an old car with less and less residual value, collision coverage will become less useful over time.

Even if you retain collision coverage, you can often save money on your monthly insurance bill by choosing a higher deductible amount. You would pay a larger portion out of pocket than with a smaller deductible if the vehicle is damaged, but you may “make back” in savings in that difference in a smaller monthly insurance bill. Read more about collision coverage and whether and how you should make use of it when another driver damages your vehicle and has property damage liability coverage available.

Comprehensive CoverageComprehensive Coverage is also shown above with a $1,000 deductible. It is essentially identical to collision coverage in how it works and when it’s required by a leasing or loan company. Still, comprehensive applies to “non-moving” damage or loss causes, such as weather damage, animal damage, or vehicle theft. The choices of when and whether to drop comprehensive coverage or to change deductible amounts are also similar to those for collision coverage. Comprehensive coverage is typically much less expensive than collision coverage because vehicle damage from traffic accidents is much more common than from causes like weather damage and theft.

Comprehensive coverage also covers incidents where there definitely is not likely to be any other coverage available. If your vehicle is damaged in an auto accident, for example, it’s fairly likely the other driver will have at least the minimum $5,000 property damage liability coverage required in California. However, if a deer runs onto the highway in front of you and your vehicle is damaged when you strike it, the deer is unlikely to have its own insurance coverage, and you would need comprehensive coverage for the situation.

Other Types of CoveragesOther common types of auto policy coverages can include:

- Towing Coverage — Just what it sounds like, this coverage will pay for towing expenses on your vehicle with whatever limitations and/or deductible may be written into your policy.

- Glass Coverage — Some insurers will offer separate coverages from collision and comprehensive specifically for damage to windshields and windows. It can be a good buy, especially if you have dropped collision/comp on your vehicle or raised your deductible for those.

- Uninsured Motorist Property Damage (UMPD) — UMPD functions similarly to collision coverage, but as the name suggests, it only covers your vehicle for damage caused by an uninsured motorist. Typically, it has a smaller deductible than collision coverage (so it can benefit you even if you already have collision coverage) and being less expensive than collision coverage it can be a good option to add or retain if you later drop collision coverage from your policy.

For more information about the insurance industry, their tricks and tactics handling claims, and how an experienced attorney can successfully counter those tactics to maximize settlement value, see the links below:

- Insurance Company Tactics — Dirty Tricks Insurance Companies Play in Accident Claims

- Our Tools: How an Experienced Personal Injury Attorney Deals with Insurance Company Tactics

- The Insurance Industry and Individual Companies: Huge and Hugely Profitable

Editor’s Note: This page has been updated for accuracy and relevancy [cha 12.10.20]

Photo by Scott Graham on Unsplash

:GM cha [cs 1593]

Additional Resources: